In Austria, non-resident companies often face challenges in navigating the complex landscape of accounting and tax regulations. Austrian accounting firms assist foreign entities in managing their financial obligations while conducting business in the country. These firms play a crucial role in ensuring compliance with Austrian tax laws, providing services ranging from obtaining a VAT number to submitting annual reports. This support is vital for foreign companies to fulfill their financial responsibilities in Austria.

This article explores the main aspects of accounting and tax compliance for non-residents in Austria and lays the foundation for how House of Companies has innovated and simplified Austrian accounting.

It covers key topics such as corporate income tax, bookkeeping rules, and the participation exemption. By understanding these elements, non-resident companies can effectively manage their finances and capitalize on opportunities in the Austrian market.

In Austria, non-resident companies often find it challenging to navigate the intricate world of accounting and tax regulations. Austrian accounting firms help foreign businesses manage their financial affairs while operating in the country. These firms are essential for ensuring compliance with Austrian tax laws and regulations, assisting with tasks ranging from VAT registration to the submission of annual reports.

This article examines the primary components of accounting and tax compliance for non-residents in Austria and outlines how House of Companies has streamlined Austrian accounting processes. Key topics discussed include corporate income tax, bookkeeping standards, and the participation exemption. A firm grasp of these aspects enables non-resident companies to manage their financial obligations efficiently and seize opportunities in the Austrian business environment.

In summary, non-resident companies conducting business in Austria must navigate local accounting services and tax compliance. This article has highlighted key areas such as corporate income tax, bookkeeping regulations, and the participation exemption.

Understanding the Austrian tax system is essential, particularly concerning permanent establishments. By familiarizing themselves with these elements, non-resident companies can enhance their financial management and leverage opportunities in the Austrian market.

The complexity of Austrian accounting regulations underscores the importance of seeking expert assistance to comply with the law and avoid potential penalties. Staying informed about tax obligations and deadlines enables non-resident companies to maintain good standing with Austrian authorities and focus on their core business operations.

To save costs with accounting software and request a demo or draft financial reports, contact House of Companies. Ultimately, non-resident businesses must comprehend Austrian accounting services and compliance requirements to thrive in the Austrian business landscape.

Austria has a comprehensive legal framework governing financial reporting, primarily based on the EU Accounting Directive 2013/34/EU and integrated into the Austrian Commercial Code (Unternehmensgesetzbuch, UGB). This framework is complemented by Austrian Accounting Standards issued by the Austrian Financial Reporting and Auditing Commission (AFRAC) and the International Financial Reporting Standards (IFRS) as adopted by the EU.

Entities with securities other than shares listed on a regulated market in the EU/EFTA must comply with additional reporting requirements under the Austrian Financial Markets Supervisory Authority (FMA). These obligations include publishing annual financial reports within four months after the end of the financial year and half-yearly financial reports within three months after the first six months of the financial year.

Annual financial reporting typically includes the management report, audited financial statements, supplementary information, and declarations by the management board attesting to the accuracy and fairness of the presented financial statements and management report. Companies engaged in the extractive industry must also publish an annual report on payments to governments within six months of the financial year-end.

For corporate tax purposes, an Austrian company with substance, i.e., a permanent establishment (PE), is liable for corporate income tax (CIT) on its worldwide income. In contrast, a non-resident company without a PE in Austria is only liable for CIT on Austrian-source income, such as profits from a PE or income from Austrian real estate.

The term 'permanent establishment' is defined under the Austrian CIT law and aligns with definitions in applicable tax treaties. For non-treaty situations, the definition corresponds with Article 5 of the OECD Model Convention 2017.

Regarding value-added tax (VAT), an Austrian company with substance must register for VAT and charge VAT on its supplies of goods and services. A non-resident company without a PE in Austria may still need to register for VAT if it makes taxable supplies in the country, such as distance sales or e-services to non-VAT registered customers.

In summary, the presence of a permanent establishment is a crucial factor in determining the corporate tax and VAT obligations of a company operating in Austria.

Non-resident entities looking to establish a presence in Austria have several legal entity options, each with distinct accounting and tax implications. The most common types include branch offices, subsidiaries, and foreign legal structures.

A branch office, also known as a permanent establishment (PE), is not a separate legal entity but an extension of the foreign company. It must be registered with the Austrian Commercial Register and is subject to corporate income tax and VAT on profits attributable to the branch.

While branch offices are not required to file separate financial statements with the Commercial Register, the parent company's financial statements must be submitted.

Subsidiaries, on the other hand, are independent legal entities incorporated under Austrian law. They must register with the Commercial Register, file annual financial statements, and comply with all Austrian tax obligations, including corporate income tax, VAT, and payroll tax. Subsidiaries offer greater administrative simplicity and independence compared to branch offices.

Foreign companies can also opt to use their home country's legal structure when establishing a business in Austria. Austrian company law recognizes all foreign business structures except sole proprietorships. However, using a foreign legal structure may present complexities, such as dealing with multiple tax authorities.

Registering a branch office in Austria entails several accounting obligations. The branch must maintain proper books and records, and the foreign company's financial statements must be filed with the Commercial Register. If the branch employs staff, it must establish an Austrian payroll system and withhold wage tax and social security premiums.

The profits of the branch office are subject to Austrian corporate income tax, and it must file quarterly VAT returns. Transfer pricing rules apply to transactions between the branch and its foreign head office, necessitating proper documentation to substantiate the allocation of profits.

The decision to establish a branch office, subsidiary, or use a foreign legal structure depends on various factors, including the nature and extent of activities in Austria, tax implications, and administrative simplicity.

Non-resident entities should consult legal and tax advisors to determine the most suitable option for their specific situation. House of Companies can assist with this through a corporate plan for a fixed fee.

Non-resident entities operating in Austria must comply with various tax registration requirements to ensure compliance with Austrian regulations. These obligations include registering for value-added tax (VAT), payroll taxes, and corporate income tax, depending on the nature and extent of their business activities.

VAT for Businesses with VAT Taxable Transactions

Businesses engaged in VAT-taxable transactions in Austria are required to register for an Austrian VAT number. This applies to both resident and non-resident companies supplying goods or services within the country.

The registration process involves submitting an application to the Austrian Tax Authority (Bundesministerium für Finanzen), providing necessary documentation such as proof of business incorporation and identification documents, and appointing a fiscal representative for non-resident businesses.

Once registered, companies must charge VAT on their supplies, file periodic VAT returns, and maintain proper records of their transactions. The standard VAT rate in Austria is 20%, with reduced rates applicable to certain goods and services. Non-compliance with VAT obligations can result in penalties and legal consequences.

Register as Employer When You Payroll Staff in Austria

Businesses employing staff in Austria are obligated to register as an employer with the Austrian Tax Authority and deduct payroll taxes from their employees' wages.

Payroll taxes include wage tax, national insurance contributions, and employee insurance premiums.

Employers must file payroll tax returns and remit the withheld amounts to the tax authorities. Before employing staff, companies must register as an employer and obtain a payroll tax number. They are also required to verify their employees' identities and eligibility to work in Austria. Failure to comply with payroll tax obligations can lead to penalties and legal repercussions.

Resident companies in Austria are subject to corporate income tax on their worldwide income. The standard corporate income tax rate is 25%, with a lower rate applicable to the first portion of taxable income. Companies must file annual corporate income tax returns and make advance payments throughout the year.

Non-resident companies are liable for corporate income tax only on their Austrian-source income, such as profits attributable to a permanent establishment in Austria. They are required to file corporate income tax returns and pay taxes on their taxable income.

A critical question for businesses is whether their company is considered a resident in Austria. In principle, all companies incorporated under Austrian law are considered 'resident,' unless specific tax treaty conditions are met.

Non-resident entities operating in Austria are subject to various bookkeeping and financial reporting obligations under Austrian law. These requirements are primarily governed by the Austrian Commercial Code and Austrian Generally Accepted Accounting Principles.

Almost every Austrian corporate entity is required to prepare financial statements according to the law, usually incorporated into the entity's statutes. These financial statements are essential for the Austrian legal system and form the basis for corporate governance. They also play a significant role in taxation, as they serve as the starting point for determining the taxable basis.

Content of Financial Statements

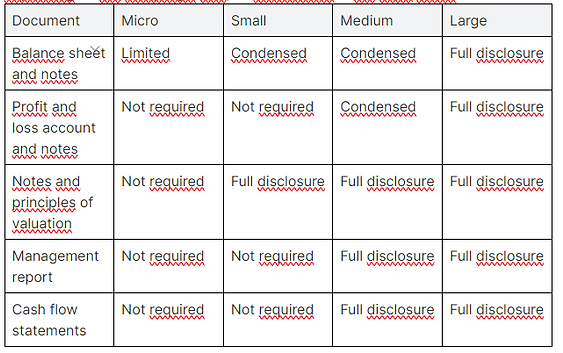

Depending on the company's size and publication requirements, financial statements must generally contain at least:

Additionally, larger companies may need to include a management report and cash flow statements. Financial statements must be prepared annually and submitted to the Commercial Register within nine months of the financial year-end.

Bookkeeping Rules

Austrian law stipulates bookkeeping rules that entities must follow, ensuring proper documentation of all financial transactions. Companies must maintain accurate records of income and expenses, supporting documents (invoices, contracts, etc.), and bank statements. Proper bookkeeping practices are crucial for compliance and for providing reliable financial information for decision-making.

Companies must also adhere to the specific bookkeeping standards applicable to their size and legal structure. Regular internal audits and assessments of bookkeeping practices are advisable to ensure compliance with Austrian regulations and standards.

Austria's tax system consists of various direct and indirect taxes imposed on individuals and businesses. The primary taxes relevant to businesses include corporate income tax, value-added tax, and payroll tax.

Compliance with the Austrian tax system requires an understanding of tax regulations, deadlines, and reporting requirements.

The participation exemption is a key feature of the Austrian corporate tax system that allows Austrian companies to benefit from the exemption of foreign dividends and capital gains from taxation under specific conditions.

Under the participation exemption, dividends received by an Austrian company from qualifying shareholdings in foreign companies, as well as capital gains from the sale of such shareholdings, are generally exempt from corporate income tax.

To qualify for the participation exemption, certain conditions must be met, including a minimum ownership threshold and a holding period requirement. This exemption encourages Austrian companies to invest in foreign entities and promotes international business activities.

Under Austrian law, almost every corporate entity is required to prepare financial statements in accordance with the provisions of the Austrian Commercial Code (UGB). These statements are crucial for maintaining the integrity of the Austrian legal system and serve as the foundation for effective corporate governance. Additionally, the financial statements are essential for taxation purposes, forming the basis for determining taxable income, although tax laws operate under independent regulations.

The specific content of the financial statements depends on the size of the company and its publication requirements. Generally, all entities must prepare at least a balance sheet, an income statement (profit and loss account), and notes to the accounts. These documents must accurately reflect the company's financial position, and any changes in accounting principles must be disclosed in the notes.

Austrian law mandates that only medium-sized and large companies are required to have their annual reports audited by an independent, qualified auditor.

Non-resident entities operating in Austria are subject to varying audit requirements based on their size and legal structure.

Criteria for Medium and Large Companies: According to the UGB, companies are categorized as medium or large based on three factors: total assets, net sales, and the number of employees. A company meeting at least two of the three criteria for two consecutive years is subject to mandatory audits.

Auditor's Report: The appointed auditor must report on whether the financial statements provide accurate information according to generally accepted accounting principles in Austria, confirming that the management board's report meets legal requirements and that adequate information has been provided.

Voluntary Audits: Non-resident entities that do not meet the audit criteria may opt for a voluntary audit, enhancing their credibility and facilitating compliance with local regulations.

Foreign businesses operating in Austria must comply with Austrian VAT regulations as stipulated in the Austrian VAT Act.

VAT Residency: Non-resident companies can choose to establish VAT residency by opening a local office or hiring local staff, which simplifies VAT compliance.

Art. 21 Exemption: Alternatively, non-resident companies can maintain their non-resident status and utilize the Art. 21 exemption, allowing them to defer VAT on imports while complying with additional administrative requirements.

Bonded Warehouses: Foreign businesses can manage VAT obligations through bonded warehouses, deferring import duties and VAT until goods are released for circulation within the EU.

Non-resident entities in Austria can choose between preparing financial statements under Austrian GAAP or IFRS.

Austrian GAAP: Governed by the UGB and the Austrian Accounting Standards Board, Austrian GAAP is primarily aligned with EU regulations. Companies must comply with specific reporting requirements based on their size and listing status.

IFRS: As an internationally recognized set of accounting standards, IFRS provides benefits such as enhanced comparability and improved transparency, which can facilitate access to global capital markets. However, transitioning from Austrian GAAP to IFRS requires careful planning and consideration.

Dividends from Austrian corporations are typically subject to a 27.5% Austrian dividend withholding tax (WHT). However, exemptions may apply under Austrian tax law, particularly for recipients from the EU or states with a relevant tax treaty with Austria.

Austrian law requires parent companies to include the financial data of controlled subsidiaries in their consolidated financial statements. A "controlled subsidiary" is defined as an entity where the parent can directly or indirectly exercise more than 50% of voting rights.

Dividend payments received from subsidiaries should be recorded as financial income in the parent company's income statement, with a corresponding receivable on the balance sheet. Outgoing dividends should be recorded as a reduction in retained earnings, with a liability noted until payment is made.

According to the UGB, the management board must prepare financial statements within six months after the financial year ends. The financial statements must then be approved by the general meeting within two months.

Filing Requirements: After adoption, the financial statements must be filed with the Austrian Commercial Register within a month. Required documents include:

Failure to meet filing requirements can result in penalties under Austrian law. Management board members may face personal liability for damages incurred by third parties due to non-compliance.

The audit requirements in Austria are determined by company size based on total assets, net sales, and employee count. Companies must meet at least two of these criteria for their respective size category for two consecutive years to be subject to mandatory audits.

At House of Companies, we provide comprehensive support for non-resident entities navigating Austrian accounting regulations and compliance requirements. Our team of experts assists with:

Preparation and Filing: We help in the preparation and filing of financial statements and management reports, ensuring compliance with local laws.

Audit Assistance: We coordinate with independent auditors and assist in facilitating voluntary audits for companies seeking to enhance their credibility.

VAT Compliance: Our services include guidance on VAT residency, exemptions, and managing obligations through bonded warehouses.

Reporting Framework Selection: We provide insights into choosing between Austrian GAAP and IFRS, ensuring a smooth transition and compliance with financial reporting standards.

For personalized assistance and to ensure compliance with Austrian regulations, contact House of Companies today.

What are the annual accounts filing obligations for companies in Austria?

Under Austrian law, all corporate entities are required to prepare annual financial statements that comply with the applicable accounting standards. This includes a balance sheet, income statement, and explanatory notes, reflecting the company's financial position.

What is the significance of financial statements in Austria?

Financial statements serve as a crucial tool for corporate governance, taxation, and providing stakeholders with an accurate overview of the company’s financial health. They form the basis for tax assessments and are essential for informed decision-making.

What are the minimum content requirements for financial statements?

The financial statements must generally include:

Who must have their financial statements audited in Austria?

Only medium and large companies, as well as those applying International Financial Reporting Standards (IFRS), are legally required to have their financial statements audited by a qualified auditor. Micro and small companies are exempt from this requirement.

How is a company’s size determined for audit requirements?

The size of a company in Austria is determined based on criteria such as total assets, net revenue, and the number of employees. If a company meets two of three specified thresholds for two consecutive years, it must undergo an audit.

What are the deadlines for preparing and filing financial statements in Austria?

The management board must prepare the financial statements within five months after the end of the financial year. The statements must be adopted at the general meeting within two months thereafter. Once adopted, the financial statements must be filed with the relevant commercial register within 14 days.

What are the penalties for failing to comply with annual reporting requirements?

Failure to comply with annual reporting requirements may result in penalties under the Austrian Commercial Code. Management board members can be held personally liable for any damages caused by non-compliance.

How does VAT compliance work for foreign businesses in Austria?

Foreign businesses must adhere to Austrian VAT regulations, which require them to register for VAT if they exceed certain sales thresholds. They may opt to become resident for VAT purposes or maintain their non-resident status and apply for exemptions where applicable.

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!