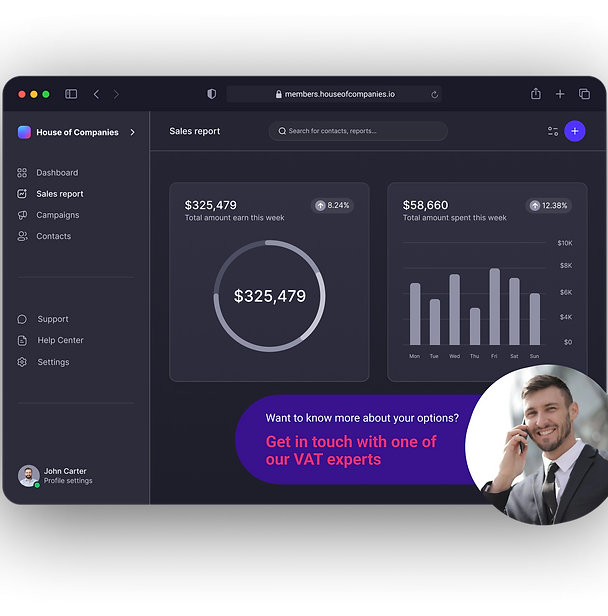

Expand your existing company, from any country in the world, into Austria without breaking a sweat! Remote, and fully online, House of Companies can register your foreign entity as a branch in Austria, and apply for all necessary tax numbers, register as an Employer, and more!

One fixed fee for branch registration, and Austrian accounting services!

SMART Companies in Austria are reshaping the traditional business model by capitalizing on blockchain’s immutable ledger system. This decentralized structure ensures transparency, security, and efficient corporate management, making it ideal for modern entrepreneurs. The distributed ledger system eliminates the need for intermediaries, providing egalitarian control and reducing costs.

Registering a SMART Company on blockchain in Austria is a forward-thinking move for modern entrepreneurs. House of Companies supports clients throughout the process, making it simple, even for those unfamiliar with blockchain. Here's a step-by-step guide:

Austria provides a favorable environment for SMART Company registration, particularly for blockchain-based businesses. Austria’s government supports digital innovation and has developed regulations to facilitate the growth of blockchain technology in a secure and transparent manner.

House of Companies provides tailored services for setting up a SMART Company in Austria, helping you navigate local regulations. Our support includes:

If you’re looking to establish a branch of a SMART Company in Austria, such as one registered in another jurisdiction (e.g., Seychelles or Delaware), the following steps apply:

"The Smart Company registration process in Austria was seamless thanks to the Self-Governance Portal. The integration of blockchain technology ensured a secure and transparent setup, and the expert support made everything straightforward. I highly recommend it for anyone looking to establish a business in Austria."

Alex JFounder of Tech Innovators Inc.

Alex JFounder of Tech Innovators Inc."Using the Smart Company registration service was a game-changer for us. The integration with Austrian regulations made the process seamless, and the enhanced security provided peace of mind. The team’s support was exceptional, making our expansion into Austria completely hassle-free."

Maria LCEO of Global Ventures Ltd.

Maria LCEO of Global Ventures Ltd."We were impressed by how quickly and efficiently we could establish our business in Austria using the Self-Governance Portal. The blockchain technology offered us transparency and reliability, and the customer service was exceptional. It’s a fantastic solution for international businesses looking to expand in Austria."

David RDirector at InnovateTech Solutions

David RDirector at InnovateTech SolutionsSMART Companies, leveraging blockchain, have several key advantages over traditional corporations:

If you’re considering entering the Austrian market with a SMART Company, House of Companies can help. Our expertise in navigating Austrian regulations, combined with our Self-Governance Portal, makes it easy to get started. SMART company registration in Austria has never been easier, and with our tailored services, you can ensure compliance, reduce costs, and secure your global business footprint.

Contact House of Companies today to begin your SMART Company journey in Austria. We provide expert guidance and comprehensive support to make your blockchain business a reality in Austria’s innovative and tech-friendly environment.

Feel welcome, and try out our solutions and community, to bring your business a step closer to international expansion.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!