Are you ready to navigate the complexities of Austrian VAT registration with ease? Look no further! Our Entity Management Service is your trusted partner in securing your Austria VAT ID, offering worldwide expertise that extends beyond EU borders.

In today's fast-paced business world, efficient bookkeeping is crucial for success in Austria. Our service ensures you stay compliant while focusing on what matters most – growing your business.

Say goodbye to tedious paperwork and hello to streamlined processes. Our expert team is here to guide you every step of the way, making Austrian bookkeeping a breeze.

"Thanks to their Entity Management Service, obtaining my Austria VAT ID was smoother than I ever imagined. Their expertise is unmatched!"

Maria S.Business Owner

Maria S.Business Owner"The automated bookkeeping system has revolutionized our financial management. We couldn't be happier with the results!"

Thomas KCFO

Thomas KCFOI was hesitant at first, but the team's guidance made the entire Austria VAT registration process a breeze. Highly recommended!

John DEntrepreneur

John DEntrepreneurOur Entity Management team boasts expert international tax advisers ready to provide comprehensive support. From initial application to ongoing compliance, we've got you covered.

You can either send us your existing ledgers and VAT Analysis, or instruct us to draw up new ones from scratch.

All you known about VAT requirement for your new business

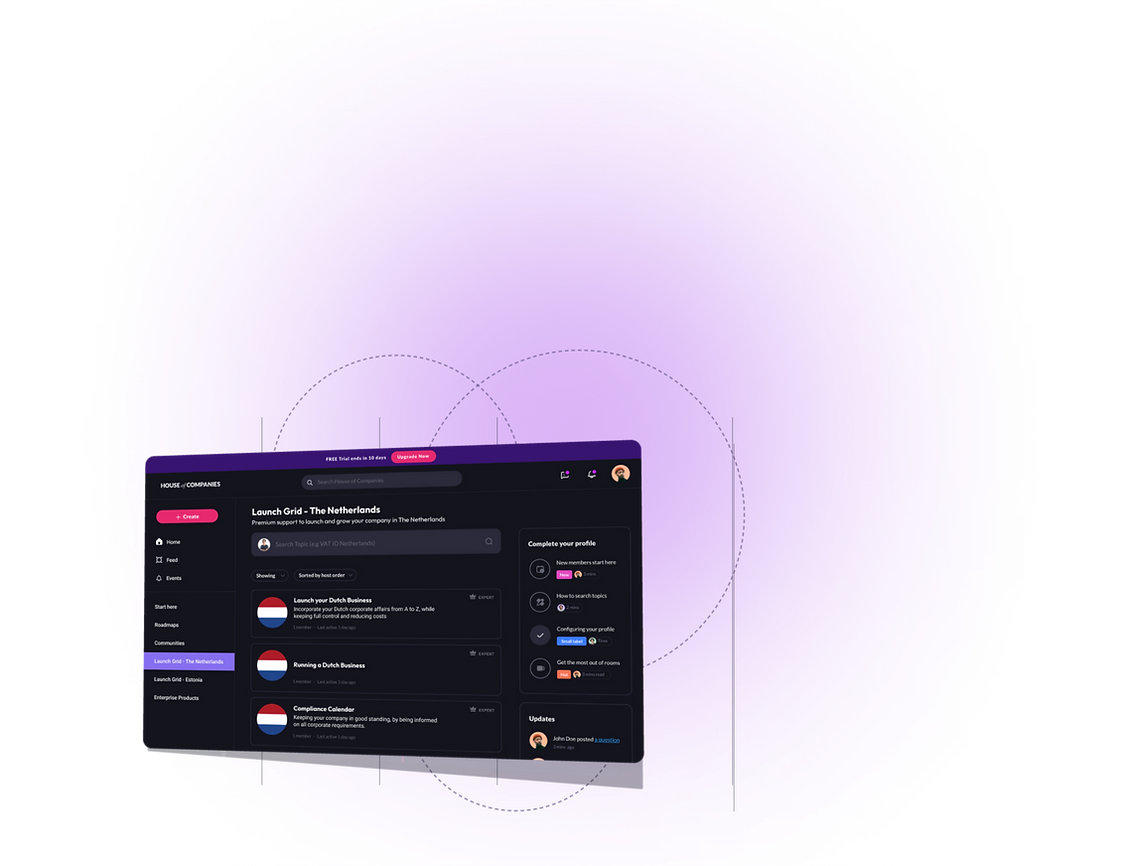

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!